The term “average person” is often used to describe the prevailing mindset in a group of people. But finding and actually pointing to this person is nearly impossible. They should be about 35 years old, half-male and half-female, not completely a millennial, not completely generation X, not completely a sports fan, etc.

The average opinion does not exist either, because opinions are uniquely personal.

When you are needing to make a big strategic decision, it helps to be targeted, be specific and have a balance between depth and breadth. Don’t go by averages. You need informed and intelligent segments within your results.

Flexible Segmentation

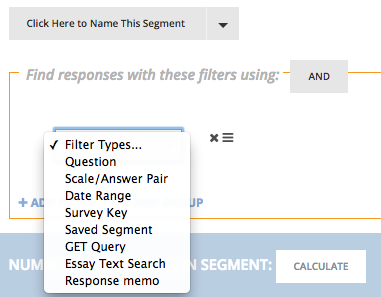

The Survature platform is very flexible when finding and creating segments. The above is the UI for segment creation. As shown, there are a variety of options for creating segments. These options address the following sources of information:

- every single question in the survey: (a) “Question” for radio, checkbox, ratings (10-point scale, e.g. net promoter score), (b) “Scale/Answer Pair” for AnswerClouds, (c) “Essay Text Search” for form or essay responses.

- temporal benchmarking: “Date Range”

- external information collected via survey targeting: “Survey Key”

- external information integrated via data overlays: “GET Query”

- manual analysis/coding on a per-respondent basis: “Response Memo”

(1) and (2) are the most commonly used. (3) and (4) are useful when your survey is set up with survey keys or external data is available for filtering. (5) is useful for very specialized cases when needing to isolate specific keywords or phrases within written feedback, please consult our user support if you feel you’d need to segment data that way.

You can further combine existing segments to form new segments by using “Saved Segment” option. But be mindful that folding segments too many times may create segment pools with too few responders leaving their results questionable.

Using these tools, we can then further create many segments flexibly. We suggest considering creating segments from two perspectives: profiling segments vs. key performance segments.

Profiling Segments

When making strategies, it is always necessary to be very targeted and specific. Targeting requires descriptive criteria. Especially for people with strategic initiative responsibilities, the following are some typical examples:

External / Customer facing: new customer, repeat customer, Broadway show audience, Rock concert audience, subscription-based customers, project-based customers …

Internal / B2B Relationship based: manufacturing employees, US-operation vs. Europe-operation, senior leadership (VPs) vs. management team (directors, managers, coordinators) …

These profiles can be effectively segmented out using questions (source #1), and/or survey targets (source #2).

Key Performance Segments

These segments are typically measured as: satisfaction, loyalty, effectiveness, productivity, value perception, wellness, … The most effective ways to get at these stratification are through question (source #1), targets (source #3) and overlays (source #4).

For most surveys, the key performance metrics are very focused and clear: promoters vs. detractors, occasional customers vs. frequent customers, satisfied vs. unsatisfied.

The Survature Action Priority Grid (APG) is a unique way to showcase key survey findings, the APGs rely on segments and typically feature the profiles as the columns, and key performance segments as the rows.

If you have too many potential ways to build key performance segments, please check out the help-doc on Identify Key Performance Feedback.